FAQ’s

What is Cost Segregation?

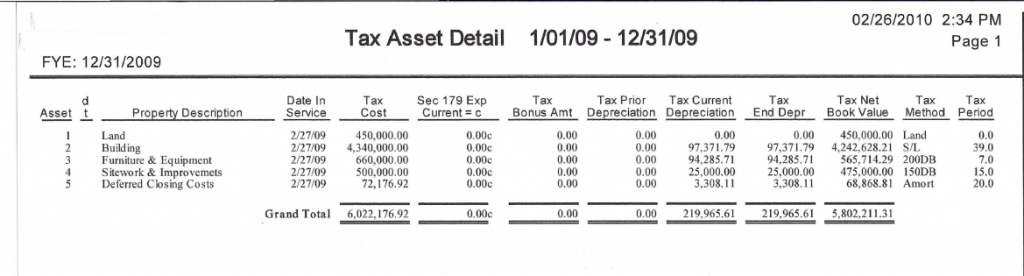

Cost segregation is an engineering-based method of accelerating depreciation on real estate properties by segregating “personal” and land improvement asset components into shorter life classification. 5, 7 and 15 year property is identified and quantified out of the existing 39 (commercial) or 27.5 (residential) year property.

Who is Cost Segregation Services Inc. (CSSI)?

CSSI is the premier national company providing quality, affordable, engineering-based cost segregation studies and tax analysis studies for businesses since 2003. CSSI has successfully completed over 30,000 studies nationally. Its national coverage and extensive expertise has allowed it to work with clients and properties across the United States. The company is headquartered in Baton Rouge LA and is owned by Jim Shreve. Jim has almost been connected to cost segregation from the start. The attorney that won the landmark case for HCA hired Jim to write the initial procedures and protocols to bring this same benefit to other property owners prior to the IRS writing the Audit Technique Guidelines.

Who is Greg Perkins?

Greg has represented CSSI since 2010 (after a 30+ year commercial bank lending career) and bottom line we bring significant income tax benefit to owners of depreciable real property. I have done 1,000+ projects in 38 states so far (our company over 30,000 studies). Income tax Deferral over $181,000,000. Very humbly I tell you my production in the last several years was 5th, 3rd, and 7th in the company nationwide.

15 minute audio interview about Cost Segregation: https://bit.ly/GPerkinsCostSeg

18 minute audio interview about Cost Segregation and 3 Legislations – Tangible Property Reg.; Tax Cuts and Jobs Act; Cares Act: https://bit.ly/GregPerkinsBradWilliams

What does CSSI Do?

CSSI is in the source document business. We provide the compliant source document that allows your tax professional to bring you income tax benefits through tax deferral. For an existing property, the benefit is a “catch up” of what has been missed out on for the duration of ownership. This catch up depreciation is brought forward into the current open tax year without amending any past returns! For a new property, our source document allows the tax professional to create the initial depreciation schedule with the best component detail from the beginning.

How do I benefit?

The accelerated depreciation will reduce your taxable income and allow you to retain the money you would have paid in income tax and use it for a more effective purpose. The typical property owners realized 5-10% of the cost basis in deferred income tax. The benefit will exceed the cost of doing the study multiple times over providing a nice return on investment (ROI). The benefit premise is the time value of money. Our analysis will assist you in calculating the Net Present Value of doing this transaction over the depreciation life of the property.

How is acceleration accomplished?

Acceleration is obtained by reducing the depreciable life such as from 39 years to 5 years. Once the asset has been identified as either a 5 or 7 year asset (personal property that is decorative or has a special purpose) then the tax professional can apply a more aggressive methodology using double declining balance, or even better, using bonus depreciation in years that it is available. For the 15 year property (land improvements) such as paving, curbs and gutters, landscaping, drainage, flag poles, light poles, etc., the tax professional can use 150% declining balance, or even better, using bonus depreciation in years that it is available. The structural components of the building, building systems and major structural components will be identified and will remain in long-term depreciation (39 years for commercial and 27.5 years for residential). 5 or 7 year personal property can qualify for Section 179 when applicable.

How do I know if Cost Segregation will benefit me?

CSSI will provide a preliminary no cost, quantitative analysis that will quantify the benefit and cost effectiveness of doing a study – all without any obligation on your part. Together with CSSI and your tax professional, all the information will be available to make an informed business decision as to move forward or not.

What do I need to provide?

For new properties, provide the type building, address, cost basis information for the building only (excluding land), and the in service date.

Sample Attached by clicking below:

What can I expect from a study?

First of all, compliance with the Audit Technique Guideline. Our compliant services will not get you, CSSI, or your tax professional in trouble. Our study source document will allow your tax professional to change your depreciation schedule in a beneficial manner so that you can defer income tax and retain the money you would have paid in income taxes – creating Cash Flow. You will also be positioned for compliance with the 2014 Tangible Property Regulation in that your schedule will identify and quantify your units of property, building systems, and major structural components. These are crucial for future expense/capitalization decisions. Moderate to large expenditures for improvements that won’t fit under the safe harbors are compared to the appropriate building system replacement cost basis in order to determine significance or insignificance under the “Ratio Test”. If insignificant, typically 30-35% or less, then you get to expense. If significant with larger %, then you must capitalize. If you don’t know the building systems, many will end up capitalizing expenditures that could have been expensed – a very expensive penalty for the property owner!

Why have I not heard of this and why hasn’t my tax professional already used this?

Your tax professional plays an important role in this process implementing the study findings on your behalf. When cost segregation began, it was very expensive and only properties with millions of dollars of cost basis could be cost effective. With the passage of time, technology and entrepreneurism, but primarily the issuance of clarification through the Audit Technique Guideline, the process became affordable for the typical property owner. Many are only now recognizing the change and considering the application for their clients. Also the 2014 Repair Regulation (Tangible Property Regulation) provided an additional need for identification of component assets for compliance and to be able to take advantage of the approval of partial disposition for buildings. The 2017 Tax Cuts and Jobs Act brought additional attention due to greater Bonus Depreciation and the 2020 CARES Act brought further interest with Qualified Improvement Property being designated as 15-year property and thus eligible for bonus depreciation.

Are there any reasons not to do cost segregation?

Yes, if some of the below apply:

- Too long existing ownership: Property may be too far depreciated. 15 years or less works for sure and sometimes 20 years or less.

- Client not making money: Benefits those making money, paying tax, and desire to pay less.

- Client selling building soon (1 or 2 yrs.): Limited benefit years prior to recapture.

- Active\Passive Income Considerations? (can self-rental be increased?; can you qualify as a real estate pro?; Can you take advantage of “grouping” of two similar legal entities under 1.469-4?)

In the past cost segregation was an economic choice. Now with the 2014 Tangible Property Regulation, compliance is another important reason beyond economic benefit. For those clients that can’t benefit from accelerated depreciation, there are now reasons to do at least an “abbreviated study” for compliance. There is now a need for identification of cost basis to each unit of property and the need to identify and quantify the various building systems and major structural components in both cost and replacement cost to facilitate partial dispositions and providing crucial detail for making future expense/capitalization decisions.